There’s a motive why small enterprise employers and operators outsource their payroll processes to payroll software program.

Should you’re the proprietor of a rising enterprise who looks like payroll takes an excessive amount of time and vitality out of your already busy schedule, you’re not alone. Round 70% of small enterprise house owners really feel that payroll provides a considerable burden to their workload (1).

It’s not nearly tallying up hours and writing paychecks — it’s a must to make sure that your payroll is error-free since you may:

- Find yourself dropping staff as a result of a single paycheck error

- Incur steep fines from the Inner Income Service (IRS) for late or inadequate tax funds (2)

- Face lawsuits or fines for misclassifying staff as unbiased contractors (3)

However we’re right here that can assist you analysis — and evaluate — the highest payroll instruments for small companies. We’ve created this information to interrupt down the number of capabilities that payroll software program can carry out for you and discover among the distinctive options that set every of those instruments aside. That method, you can begin operating payroll with peace of thoughts and and not using a lump in your abdomen.

- Nationwide Federation of Unbiased Enterprise, 2021

- IRS Knowledge Guide, 2021

- Nationwide Employment Regulation Undertaking, 2020

What’s payroll software program?

Payroll software program permits you to automate and streamline the method of monitoring worker pay, deducting the fitting state and native taxes, and issuing paychecks and direct deposits frequently. Relying on the supplier you select, payroll software program can take you from the start to the tip of the method — from the second staff fill out and e-sign their tax paperwork to when it’s a must to file tax funds and experiences. In the end, efficient payroll software program will prevent time, sources, and room for error.

High payroll companies for small companies in contrast

It’s possible you’ll be accustomed to one or two of the payroll companies listed beneath, however you won’t concentrate on what makes these companies so invaluable to small companies. Scroll down to take a look at a desk that breaks down six of the highest payroll companies primarily based on their key options.

Observe: The acronym PEPM refers back to the “per worker, per thirty days” pricing mannequin that many payroll software program suppliers use.

| Firm | Value vary per thirty days | Built-in timesheets | Limitless payroll runs | Automated payroll tax funds and filings | Cellular app | Additional options (together with HR instruments like time monitoring, scheduling, and so on.) |

| Homebase | $39 + $6 PEPM to $119 + $6 PEPM | X | X | X | X | X |

| QuickBooks | $37.50 + $5 PEPM to $80 + $8 PEPM | X | X | X | X | X |

| Gusto | $40 + $6 PEPM to $80 + $12 PEPM | With integration | X | X | X | |

| Paychex | $39 + $5 PEPM for his or her Paychex Flex Necessities plan. Gross sales workforce will give you a customized quote for his or her Choose and Professional plans. | X | X | X | X | |

| OnPay | $40 + $6 PEPM | X | X | X | X | |

| RUN powered by ADP | Gross sales workforce will give you a customized quote | X | X | X | X | X |

How to decide on the very best payroll supplier to your small enterprise

On-line payroll suppliers provide the freedom to do payroll by your self and make the method customizable and fewer daunting. Nonetheless, selecting a payroll software program answer alone may be overwhelming, so let’s check out what components you must prioritize whereas deciding.

Payroll pricing

Small enterprise house owners want to avoid wasting their pennies at any time when doable. Even so, it may be tempting for many who really feel intimidated by payroll to entrust their processes to an exterior bookkeeper who guarantees to take all the things off their arms. Nonetheless, that selection may price wherever between $500 to $2500 a month, relying in your wants. There’s all kinds of payroll software program choices accessible now — we’re right here to inform you you can deal with the method by yourself with the assistance of the fitting software program.

With that mentioned, it’s essential to determine how typically you’re going to run payroll and take into account the scale of your workforce to determine pricing. Most payroll software program suppliers cost a flat month-to-month charge plus a “per worker, per thirty days” charge that may vary wherever from $5 to $12 per workforce member. Nonetheless, some suppliers will cost you each time you run payroll. So, if you happen to plan on doing payroll weekly or bi-monthly, it could be finest to decide on a supplier that solely asks for a month-to-month charge

You’ll additionally wish to choose a payroll supplier that’s upfront about pricing and options, as you don’t wish to get hit with any further charges or pointless instruments that’ll pressure you to spend greater than you deliberate.

Ease of use

Whereas the time period “ease of use” is considerably relative, nice payroll software program shouldn’t take you a month to arrange, study, and get snug with. And sure, each on-line device comes with a studying curve. However the fitting software program for you can be intuitive and deliberately designed to foretell the way you’ll work together with it. In case your platform of selection takes greater than a day to determine, or you’ll be able to’t make sense of it and not using a customer support knowledgeable, you could wish to give it a go.

Nonetheless, the software program you select ought to supply wonderful customer support if you happen to want it. In terms of help, you must search for:

- A devoted — and authorized — buyer help supervisor or workforce

- Varied methods to get in contact, together with by textual content, electronic mail, and cellphone name

- Quick response instances

- Loads of availability all through the day

Scalability

You don’t have to stay with one payroll supplier perpetually, however it’s easier to make use of payroll software program that’s constructed to develop with you. Which means you can begin with a primary plan that gives all the easy, entry-level options you want. Then, as you acquire extra expertise with the device and broaden what you are promoting, you’ll be able to improve to plans that provide extra options.

So, for instance, if you happen to select Homebase and begin by including the payroll choice onto the free plan, you’ll have entry to our payroll instruments and our free scheduling, time clocks, hiring, and workforce messaging options. When the time is correct, you’ll be able to improve to plans that embrace options for efficiency monitoring, labor price controls and budgets, and HR and compliance.

Built-in time clocks and timesheets

Should you’ve ever executed guide information entry, you know the way a lot focus it takes to keep away from errors. And for small enterprise house owners who typically make use of hourly staff, information entry is further difficult. You need to switch worker hours to a timesheet and then convert these hours into wages.

Fortunately, there are payroll suppliers that embrace built-in time clocks and timesheets. Which means whether or not staff are clocking out with a cellular app or out of your level of sale (POS) system, an efficient payroll supplier can monitor their hours and robotically convert them into wages to your timesheets. Some instruments even monitor private day off (PTO) for you.

Integrations

Should you’re the proprietor of a restaurant or retail retailer, you could want to make use of industry-specific platforms like Restaurant365, Bevspot, or Shopventory for stock and workforce administration. These instruments, nevertheless, sometimes don’t have sturdy payroll options.

As an alternative of getting to switch that information manually, choose a payroll answer that gives devoted software program integrations for the {industry} instruments you want. The small enterprise payroll software program you select must also combine together with your POS so you’ll be able to monitor labor and gross sales prices alongside one another.

Automated tax funds and filings

In case your small enterprise tax funds and filings are providing you with nightmares, we really feel your ache. You don’t wish to need to pay tax penalties for underpaying or making late funds, which might add as much as 5% to 25% of what you owe.

No want to fret — automated tax funds and filings are among the main causes small companies spend money on payroll software program, particularly if it affords worker self-service.

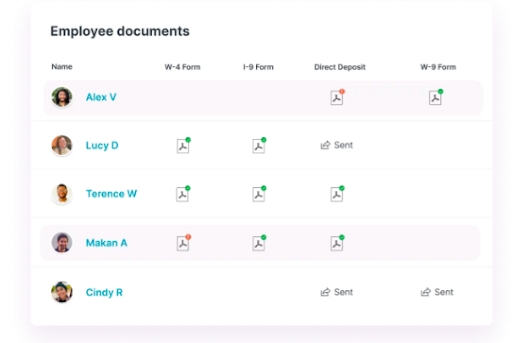

Which means you’ll be able to ask your staff to self-onboard with a payroll app and fill out their very own tax varieties once you rent them. And as soon as your payroll platform processes and shops their tax particulars, it’ll robotically replace your timesheets with every worker’s tax info. You gained’t need to reference worker W-4s to see how a lot tax it’s essential to withhold from each paycheck — your payroll software program ought to calculate that for you and even ship appropriate funds to the state and the IRS.

Cellular app

Loads of small enterprise house owners attempt to bootstrap issues on their very own and are reluctant to depend on administrative and managerial workers. That usually interprets into carrying numerous totally different hats and managing duties away from their workplaces and storefronts on their days off. That’s why a payroll supplier with a cellular app is a superb choice for employers who want extra flexibility in the place they work from everyday.

There are many payroll options with cellular apps that’ll allow you to run payroll out of your cellphone. However some (like Homebase) give staff the choice to entry their schedules, earnings, pay stubs, and W-2s with the app as nicely. The Homebase platform will even let staff request early entry to their wages and notify them with texts after they get their paycheck.

Taking a better take a look at high payroll suppliers for small companies

We’ve given you a visible comparability of the highest payroll suppliers facet by facet, however let’s take an in-depth take a look at every of them to see what makes them stand out.

Homebase

Supply: https://joinhomebase.com/payroll/

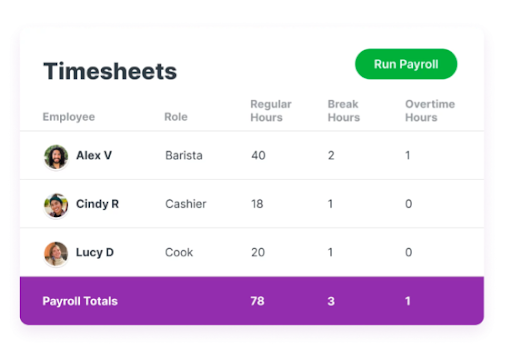

Caption: Homebase robotically converts worker hours into timesheets for payroll.

Homebase is an all-in-one answer that lets small enterprise house owners handle scheduling, time monitoring, payroll, and HR for his or her staff. It’s additionally particularly designed to make managing hourly staff extra handy. We’ve helped small enterprise house owners throughout a variety of industries — from meals and beverage to retail to magnificence and wellness — and we satisfaction ourselves on simplifying processes like payroll, HR, and workforce administration so entrepreneurs can concentrate on the big-picture duties that assist them develop.

What makes Homebase distinctive

Homebase customers can join the Fundamental plan without spending a dime. Additionally they get entry to our easy-to-use instruments for scheduling, time clocks and timesheets, messaging, and hiring.

When you and your staff get snug with how our platform works, you’ll be able to add payroll for $39/month plus $6 per worker per thirty days. Then, you’ll be able to have your staff self-onboard and e-sign needed tax paperwork, just like the W-4 and 1099. You’ll additionally be capable to sync your worker time clocks with payroll. That method, when staff clock out and in on the cellular app, our payroll device will robotically replace their timesheets with their wages and tax withholdings.

Supply: https://joinhomebase.com/payroll/

Caption: You may retailer and entry worker paperwork with Homebase’s cellular app.

QuickBooks

Supply: https://quickbooks.intuit.com/payroll/

Caption: You may bundle QuickBooks Payroll collectively together with your different Intuit merchandise.

You is perhaps accustomed to QuickBooks’ accounting software program, however do you know additionally they have a devoted payroll platform? In actual fact, QuickBooks permits you to bundle its bookkeeping and payroll options collectively so you’ll be able to monitor what you are promoting and labor prices facet by facet.

What makes it distinctive

QuickBooks payroll is a superb answer for people who find themselves searching for a platform that’s suitable and straightforward to combine with Intuit’s suite of merchandise.

If you have already got a Quickbooks account for bookkeeping, you’ll be able to activate payroll by QuickBooks On-line. And with their Payroll Core plan, you’ll be capable to run payroll robotically, however you may as well supply your staff next-day direct deposits, 401(okay) plans, and well being advantages administration and handle it multi functional place.

Gusto

Supply: https://gusto.com/

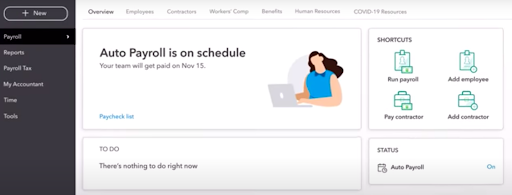

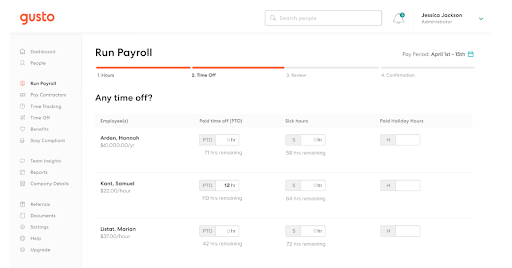

Caption: Gusto offers you entry to workforce insights and experiences along with payroll instruments.

Gusto is a extensively identified small enterprise payroll answer that was initially designed for workers to entry and replace their payroll info and obtain their pay stubs. Nevertheless it has since expanded to incorporate options for tax submitting, hiring and onboarding, HR companies, insurance coverage, and worker advantages. Gusto additionally affords integrations for accounting instruments like Xero, QuickBooks, and Clover.

What makes it distinctive

Gusto is nice for small enterprise house owners within the accounting or private finance industries. Why? As a result of with Gusto for Accountants, you’ll be able to accomplice with Gusto to entry perks like income sharing, consumer reductions, and even earn persevering with skilled schooling (CPE) credit.

Should you select Gusto that can assist you run payroll to your small enterprise, you may as well give your staff entry to a Gusto Pockets spending account. With that, they’ll entry, monitor, price range, and spend their paycheck with their Gusto Pockets card.

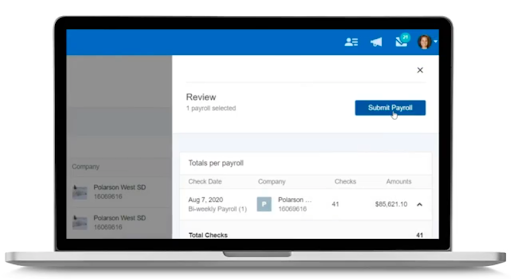

Paychex

Supply: https://www.paychex.com/

Caption: Paychex permits you to select your payroll plan primarily based in your firm dimension.

Paychex affords options for payroll, HR, enterprise insurance coverage, worker advantages, and time and attendance monitoring. Their Paychex Flex plans, which consult with their payroll bundles, supply three tiers of payroll choices for companies from 1 to 1000 staff. You can too customise every plan to suit your particular wants.

What makes it distinctive

Whereas it is dependent upon the plan you select, Paychex Flex is a helpful choice for brand new enterprise house owners who want some coaching to get a deal with on payroll-related points outdoors of their experience.

With a Paychex Flex Choose and Professional Plan, you have got entry to a devoted payroll specialist and HR companies like coaching modules which can be nice for brand new enterprise house owners. And with Paychex’s Flex Professional plan, you’ll be able to even run background checks.

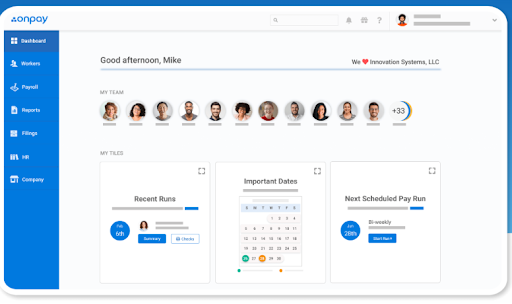

OnPay

Supply: https://onpay.com/

Caption: Staff can create private profiles with OnPay’s platform.

OnPay is a cloud-based enterprise answer that permits you to automate your payroll, however it additionally contains options for HR and advantages. You may combine OnPay with standard software program, together with accounting options like QuickBooks and Xero, time monitoring options like Once I Work, retirement and 401(okay) options like Guideline, and HR and compliance options like Mineral.

What makes it distinctive

OnPay lets staff create their very own private profiles inside the software program, which they’ll use to entry their tax paperwork and paystubs, which is a useful HR characteristic that retains everybody updated.

And, if you happen to’re searching for probably the most reasonably priced insurance coverage to your staff, OnPay can function your insurance coverage dealer and consolidate plans primarily based in your state. They’ll additionally do the executive work of updating and managing your medical health insurance plan when you’ve chosen one for what you are promoting.

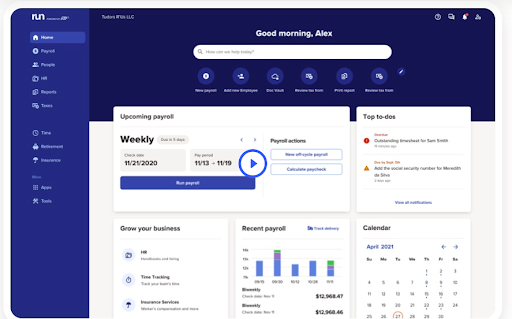

RUN powered by ADP

Supply: https://runpayroll.adp.com/

Caption: With a RUN Necessities plan, you’ll be able to entry payroll, taxes, and compliance instruments.

ADP has been within the HR and payroll companies {industry} for many years, however the RUN product is particularly designed for small companies of as much as 49 staff. ADP additionally affords 4 tiers of plans — Important, Enhanced, Full, and HR Professional — that work for companies at each stage of progress. You will get a customized quote for every plan by contacting the gross sales workforce.

What makes it distinctive

ADP’s most elementary plan — the Necessities plan — affords prospects help with payroll, taxes, and compliance. And with the preferred plan, the Enhanced plan, you’ll get entry to options for garnishment fee companies, state unemployment insurance coverage (SUI) administration, background checks, and job posting with ZipRecruiter.

For companies with extra in-depth HR and authorized wants, the HR Professional plan affords entry to an HR help workforce, employer/worker coaching, enterprise recommendation, and even authorized recommendation from Upnetic Authorized Companies.

How Homebase makes small enterprise payroll a breeze

As you analysis payroll instruments to your small enterprise, communicate with gross sales groups, and check out instruments for your self, keep in mind: You may all the time change your thoughts sooner or later.

As a result of although there’s all kinds of payroll instruments that declare to be small enterprise options, not all of them perceive the particular challenges that small enterprise house owners — notably those that make use of hourly staff — face.

Homebase understands that retail operators, restaurateurs, and accountants all require several types of options. That’s why we’ve made our instruments for scheduling, time monitoring, workforce communication, and hiring free, with the intention to simply combine the instruments you want with our payroll choice. And, with our upfront pricing and intuitive options, we’ve made it tremendous easy and reasonably priced so as to add payroll instruments onto any Homebase plan you select.