Working payroll isn’t precisely enjoyable. However each enterprise proprietor must do it in the event that they need to maintain staff completely happy (and paid!)

The payroll course of covers all the pieces that goes into paying staff whereas staying compliant with labor and tax legal guidelines — like registering for tax IDs, precisely monitoring hours, calculating and withholding taxes, and sharing pay stubs.

It’s rather a lot, we get it. That’s why we’re going that can assist you study what payroll truly is, easy methods to do it proper, and what steps go into choosing the appropriate software program to arrange your payroll course of.

What’s payroll?

Mainly, payroll is the method of paying your staff. It contains duties like determining taxes — together with social safety and Medicare tax — and monitoring hours labored.

Changing timesheets into hours, processing tax filings and issuing 1099s, W-2s, and W-4 kinds, providing perks, and really distributing your worker’s paychecks — all of this falls underneath the umbrella of payroll.

As a small enterprise proprietor, you’re most likely dealing with payroll by yourself. In bigger organizations, this is likely to be delegated to an HR skilled or accountant. Fortunately, sensible instruments like Homebase provide all the pieces it is advisable get the job carried out proper with out hiring additional folks.

How payroll works with small companies

Payroll works in another way for smaller companies, primarily as a result of their wants are totally different and so they don’t want all of the bells and whistles {that a} bigger firm may. These extras have a tendency to come back with steep studying curves (and worth tags!)

The opposite key distinction is that many small companies select to pay their staff on an hourly foundation. And since hourly payroll is totally different from wage payroll, it requires totally different processes and instruments.

Hourly payroll relies on a price per hour and staff are paid in accordance with what number of hours they work. Salaried staff, then again, receives a commission a set quantity every month. Hourly payroll requires cautious calculation of every worker’s timesheets and additional time, so time clocks and worker scheduling software program are sometimes a necessity.

The totally different parts of payroll

There are a number of processes and duties that go into working payroll, and it’s not a simple process to tackle: it is advisable acquire worker data, arrange a payroll schedule, calculate and deduct tax withholdings, and an entire bunch of different stuff that may rapidly really feel fairly overwhelming.

Keep in mind that you’re not by yourself, and also you don’t should DIY payroll in your whole enterprise. Now, let’s break a few of these payroll parts down a bit of.

Payroll schedules

For small companies with hourly staff, a payroll schedule is a mixture of a pay interval, a time interval the place staff labored, and a pay date (the day your staff obtain their checks).

The commonest payroll schedules within the US are weekly, biweekly, semi-monthly, and month-to-month. Weekly schedules are finest for small companies as a result of they simplify calculating additional time funds, that are often irregular. This manner, staff additionally receives a commission as quickly as potential, which provides them extra management and adaptability over their funds.

Selecting the best schedule for your small business is essential as a result of it impacts all the pieces from payroll processing prices to worker morale to compliance with state and federal legal guidelines.

Payroll taxes

Calculating and withholding taxes are important parts of working payroll. Taxes and charges also can range by state, which may make this entire course of extra sophisticated.

Excellent news: there are solely 5 federal and state payroll taxes it is advisable know to get began:

After getting that down, examine if your small business is topic to any further state or native taxes.

Medical insurance contributions

Providing medical health insurance to staff is a superb profit that may set your small business aside and appeal to prime expertise in a aggressive labor market. However if you happen to’re primarily working the present by your self, determining how medical health insurance contributions and payroll taxes work together may be daunting.

Mainly, employer-sponsored medical health insurance premiums are pre-tax for each staff and employers. Meaning the cash you spend on worker medical health insurance premiums may be exempt from federal taxable earnings and payroll taxes (after all, it is best to all the time examine together with your Licensed Public Accountant!)

So earlier than you calculate and withhold tax, be certain to take any profit contributions and deductions under consideration.

Payroll prices

There may be fairly a couple of prices related to working payroll easily. However relying on the kind of payroll system you utilize and whether or not you outsource these actions or not, your payroll prices can range a terrific deal. When you’re utilizing a payroll service answer, you’ll have bills like:

- A base month-to-month charge and charges for every worker you could have on payroll

- 401k distribution

- Monitoring worker time

- Staff’ compensation

- Direct deposit, state, and federal tax filings

- Paid go away and additional time pay

- Bonuses

Payroll abstract studies

A payroll abstract report reveals you an summary of all of your payroll actions. This contains worker particulars like internet and gross pay and employer taxes. Sustaining and correctly storing these paperwork is essential as you’re required by the federal authorities to submit a number of payroll report kinds, together with Kind 940, Kind 941, W-2s, and W-3s.

You may additionally be answerable for an area payroll report, so be certain to examine your native employment legal guidelines to cowl your bases.

Find out how to choose the right payroll software program for your small business

You may undoubtedly course of your individual payroll manually, but it surely’s a sophisticated course of that may go away room for errors. That’s the place payroll software program is available in. These instruments aid you cut back labor prices, keep compliant with federal and state legal guidelines, and make fewer payroll errors.

There are various several types of payroll software program, together with options like Gusto, BambooHR, and OnPay. However most of those platforms aren’t made particularly with hourly staff and small companies in thoughts. Meaning they don’t provide an all-in-one answer with instruments for scheduling, time monitoring, computerized deduction calculations, and all the opposite features which can be a should for hourly payroll.

Plus, they’re typically designed for bigger corporations and aren’t geared in direction of companies with underneath 20 staff.

So when selecting a payroll supplier, be certain it’s not solely safe and scalable however truly made for a enterprise like yours!

Find out how to arrange and course of your payroll

With regards to truly establishing your payroll system, there are a couple of essential issues to remember. Earlier than you get into the nitty-gritty of it, determine what your payroll insurance policies might be and the way you’ll deal with the method.

Will you be dealing with all the pieces in-house? Or would you favor to outsource it to an accountant or on-line payroll service? And what’s your payroll schedule going to seem like? Don’t neglect to doc your insurance policies so all the pieces is publicly obtainable and may be communicated to your staff transparently.

Then, register as a enterprise with the IRS and get your employer identification quantity (EIN). Ensure that each member of your staff completes the right tax kinds, after which calculate what number of federal and state taxes it is advisable withhold from every of your worker’s earnings.

As an employer, it’s essential to additionally submit your federal tax return every quarter. Then, on the finish of yearly, you’ll have to arrange your annual filings, together with your W-2s for each workers member.

Lastly, calculate your salaries and pay your staff. All which will sound like rather a lot, however the course of may be summarized into these ten steps:

- Get your worker’s EIN

- Register with the Digital Federal Tax Fee System (EFTPS)

- Be taught your space’s payroll legal guidelines

- Decide your payroll schedule

- Report new staff to the state

- Put together the right paperwork like W-4s

- Work out new rent pay charges

- Calculate tax deductions and state taxes

- Disperse paychecks and preserve information

- Use accounting software program to assist alongside the best way

That’s proper — it may be difficult to run small enterprise payroll your self. But when that’s the trail you need to take, it’s undoubtedly potential with some persistence and energy!

How Homebase streamlines payroll for hourly staff

There are various steps concerned in finishing up the payroll course of by yourself, and they are often tough and exhausting to perform, particularly if you happen to don’t use any HR providers to help you.

Payroll software program particularly designed for small companies may also help a terrific deal. It saves you the headache of getting to recollect each single payroll step your self and working the danger of falling out of compliance, even unintentionally. That’s why we’ve highlighted how Homebase can simplify your payroll and aid you keep compliant with ease.

Time clocks

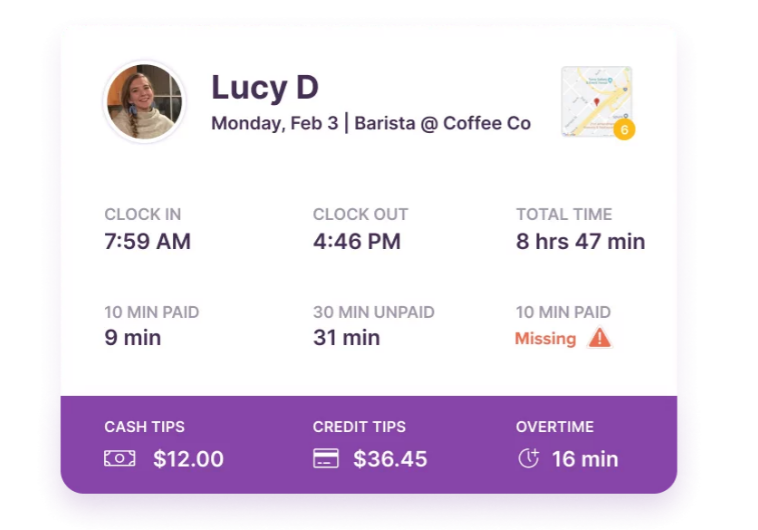

This function helps you to flip virtually any gadget with an web connection into an worker time clock system. All it is advisable do is obtain the net time clock for workers and register. Then, staff members can clock out and in with the time clock through the use of their personalised pins.

After that, you’ll be capable of monitor hours, breaks, additional time, and paid day without work. Homebase will immediately convert your timesheets into hours and wages in payroll. Timesheets and payroll, multi functional place!

Scheduling

Homebase’s scheduling answer helps you optimize worker schedules and makes certain you and your staff are all the time on the identical web page.

Immediately share your schedule together with your staff, use templates or auto-scheduling to optimize shifts, mechanically remind staff of upcoming shifts through textual content, and get alerts to keep away from additional time hours.

An optimized schedule additionally makes it simpler to trace an worker’s complete hours and learn how a lot additional time you must account for, which interprets into simpler payroll calculations on the finish of your pay schedule.

Integrations

Homebase affords varied integrations, so that you don’t have to fret about getting into and transferring information manually if you happen to’re already utilizing payroll options like Quickbooks or Sq..

From Shopify and Paychex to Vend and Toast, we be certain your entire tech stack is mechanically in sync, saving you time and slicing out pointless additional information entry.

Payroll

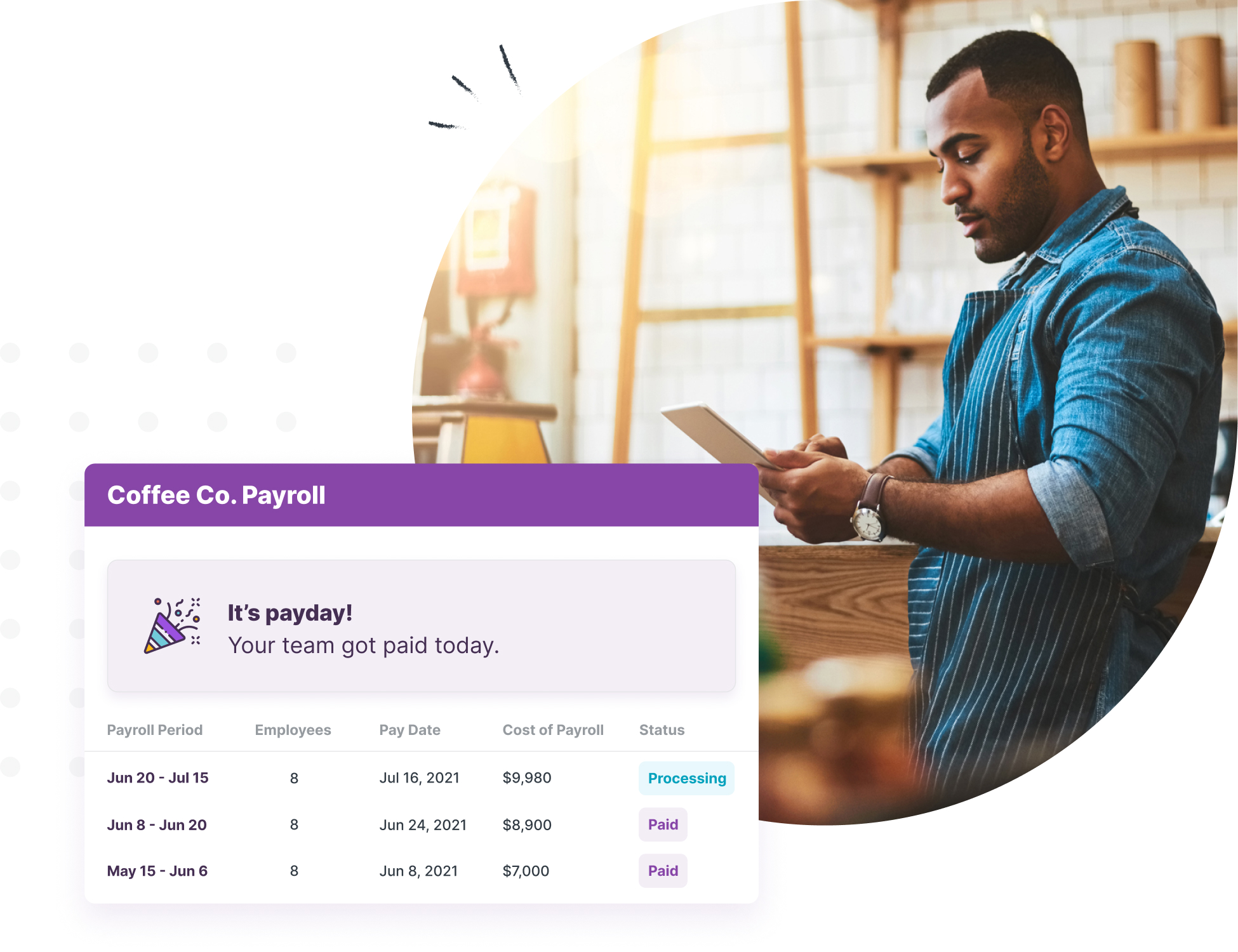

Final however undoubtedly not least, our payroll answer automates the entire payroll course of so you may concentrate on the essential stuff. Right here’s what we do:

- Calculate wages and taxes and ship out right funds to staff, the state, and the IRS.

- Robotically course of your tax filings and situation 1099s and W-2s.

- Retailer your time card information that can assist you keep compliant with FLSA record-keeping guidelines.

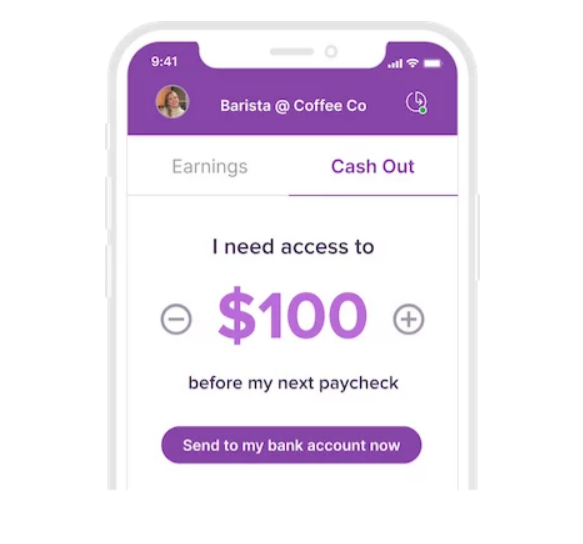

As an added perk in your staff, they’ll have the choice to entry a portion of their wages earlier than payday. This provides staff extra management when surprising bills hit, and comes at zero value or problem for you.

Seamless payroll is only a click on away

Working payroll as a small enterprise proprietor is sophisticated as a result of it includes a lot extra than simply determining wages and transferring funds.

It’s essential calculate and withhold taxes, keep compliant with federal, state, and native legal guidelines, put together payroll studies, and determine on a constant payroll schedule. And you must do all that whereas truly working your small business.

If that sounds too time-consuming and complicated, we’ve bought you lined! Homebase automates your payroll course of and takes care of all the pieces from changing your timesheets into hours and wages to mechanically processing your tax filings. You simply concentrate on rising your small business and doing what you like!