Important Avenue stays resilient regardless of the more and more lengthy checklist of challenges and countercurrents it should cope with. SMB house owners and workers have an more and more lengthy checklist of challenges to cope with: Client costs elevated on the highest price in 40 years in June. On the employment and hiring fronts, among the largest and most distinguished world firms introduced layoffs, hiring freezes, or hiring slowdowns. Client confidence and sentiment are decrease.

Specialists additionally now estimate the next chance of a recession inside the subsequent 12 months given the influence of inflation on company earnings and Fed coverage imperatives. Wall Avenue analysts proceed to scale back earnings and benchmark index estimates. Bellwether firms similar to Walmart have lowered their earnings estimates citing slowing client retail gross sales. Jobless claims proceed to rise and at the moment are on the highest weekly degree since November 2021. Constructive information contains falling commodity costs, together with for oil; decrease mortgage and rates of interest; and a nonetheless sturdy hiring market.

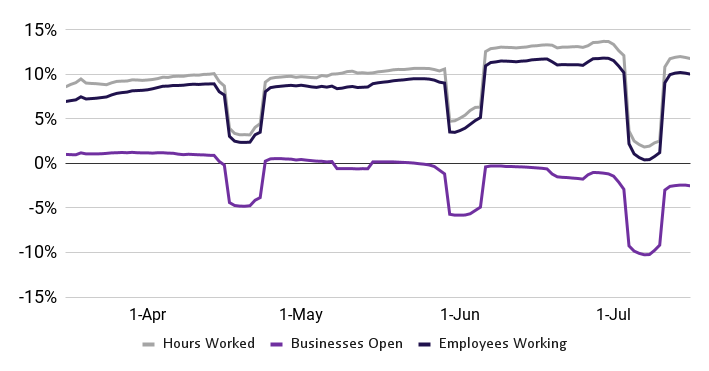

Our personal key Important Avenue Well being Metrics for July revealed some softening in hours labored (a discount of roughly 12%) and workers working relative to June. Nevertheless, these metrics stay greater relative to January of 2022 and examine favorably to the pre-pandemic interval.

Important Avenue Well being Metrics

(Rolling 7-day common; relative to Jan. 2022)

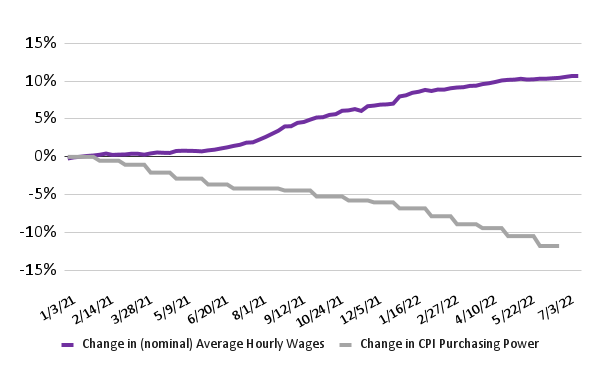

Nominal common hourly wages are up virtually 10% for the reason that starting of 2021. Common (nominal) hourly wages in mid-June remained roughly 10% above estimates from January of 2021. Proof from mid-July means that wage inflation elevated reasonably relative to June and has not stored up with inflation.

% change in nominal common hourly wages and CPI Buying Energy of the Client Greenback relative to January 2021 baseline1

1. Nominal common hourly wage adjustments and the (month-to-month) CPI for all City Customers: Buying Energy of the Client Greenback in U.S. CIty Common (non-seasonally adjusted) calculated relative to a January 2021 baseline. Sources: Homebase knowledge, U.S. BLS.

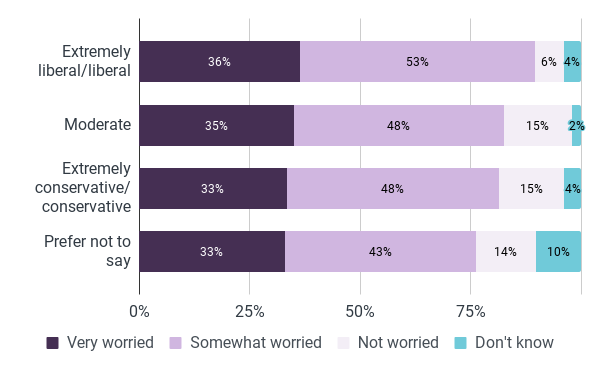

Most workers are involved a few recession; there’s some variation based mostly on political orientation. Based mostly on a pulse survey of roughly 700 workers carried out in mid-July, we discovered that workers are both very (32%) or considerably (47%) involved a few recession. There may be, nonetheless, some variation (from an general excessive baseline) based mostly on political orientation. Almost 90% of those that determine as both extraordinarily liberal or liberal are both very or considerably involved a few recession. For moderates, the determine is 82.5% and for conservatives it’s 81.4%. Those that most well-liked to not determine their political orientation had been comparatively much less involved a few recession at a nonetheless excessive 76%. One potential rationalization is the perceived influence the economic system could have on the November elections.

Survey query: Are you fearful a few recession?

Supply: Homebase Worker Pulse Survey. LR-Chi Sq. = 24.5, p < 0.004

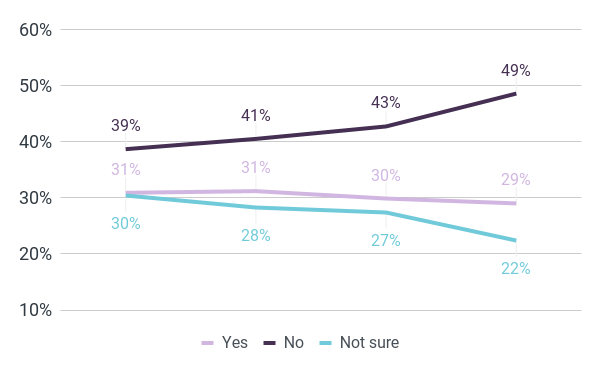

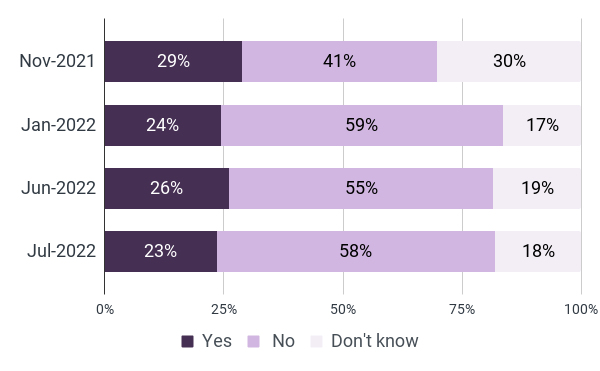

Possibly my present job isn’t so unhealthy? Macro-economic and social forces have modified how workers regard their present jobs and different job choices. 49% of workers surveyed in July indicated they do not intend to seek for a brand new job within the subsequent one to 2 years. This compares with 41% in January of 2022 and 39% in November 2021.

Survey query: Do you plan to search for a brand new job within the subsequent 12-24 months?

Supply: Homebase Worker Pulse Surveys. Ns = November (2324), January (548), June (1767), July (710).

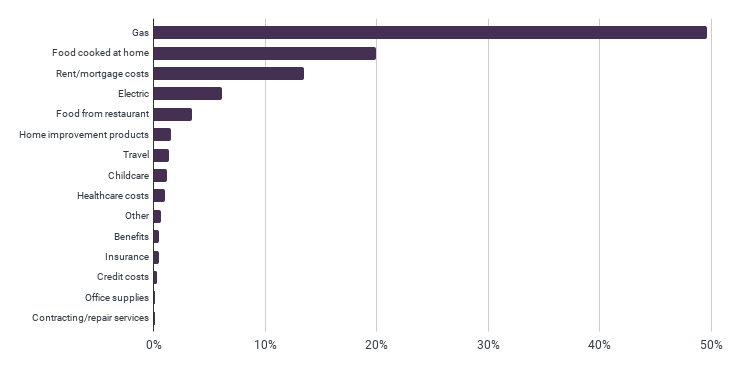

The price of gasoline is the merchandise most impacted by inflation. Meals prices and hire or mortgage spherical out the highest three classes. Per CPI knowledge, the price of gasoline was cited most steadily (50%) because the class most impacted by inflation. The price of meals cooked in a single’s dwelling was ranked first by roughly 20% of workers, adopted by hire or mortgage prices (roughly 13%). As one worker put it:

“I can’t afford something. Something. Costs are so excessive and I used to be barely scraping by because it was.”

Survey query: Which of your month-to-month prices have been most impacted by inflation?

Supply: Homebase Worker Pulse Survey.

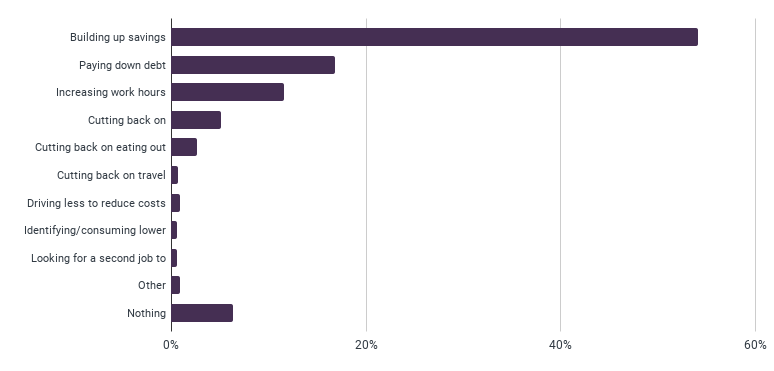

Most workers are involved a few recession; they’re additionally taking steps to arrange for one. To arrange for a potential recession, workers are build up financial savings (54%) and paying down debt (17%). Curiously, nonetheless, solely 5% are slicing down on leisure (e.g., going to films, amusement parks), consuming out at eating places (3%), or journey (<1%). These findings are per latest experiences indicating continued client power in these classes. Lastly, lower than one p.c of workers point out that they need to swap to decrease priced merchandise/providers to arrange for a recession.

Survey query: Which steps, if any, are you taking to arrange for a recession?

Supply: Homebase Worker Pulse Survey.

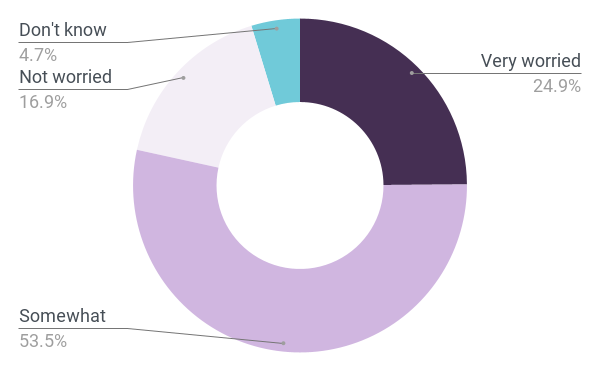

Very like their hourly workers, most house owners are involved a few recession. A July pulse survey of roughly 5 hundred house owners reveals the ubiquity of recession fears.

Survey query: Are you fearful a few recession?

Supply: Homebase Worker Pulse Survey.

Given the ubiquity of recession fears, most house owners do not plan on opening new areas. Outcomes from July 2022 resemble outcomes from January 2022 when Omicron impacted enterprise (planning). From June to July 2022, the proportion of householders who intend to open a brand new location within the subsequent one to 2 years decreased by roughly 3 proportion factors with a corresponding enhance within the proportion of householders who indicated they don’t intend on opening a brand new location within the corresponding interval.

Survey query: Do you plan to open a brand new location of your online business within the subsequent one to 2 years?

Supply: Homebase Worker Pulse Survey.

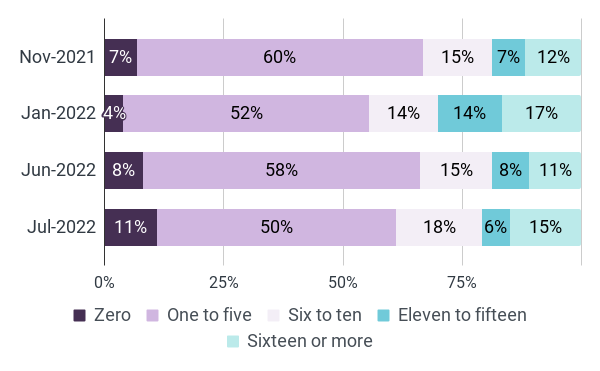

Homeowners’ hiring intentions for the subsequent one to 2 years are altering. Nevertheless, the overwhelming majority of householders intend to rent and the general common implies a headcount enhance of 30%. Most small enterprise house owners intend to rent extra workers within the subsequent one to 2 years. Nevertheless, since January of 2022, a sample is rising the place an rising proportion of householders are both planning on making no extra hires or are planning on considerably rising headcount. The proportion of householders who now intend to make no extra hires elevated greater than 37% since June and almost tripled relative to January. Alternatively, roughly 21% of householders plan on hiring eleven or extra workers.

Survey query: What number of extra employees do you plan on hiring within the subsequent one to 2 years?

Supply: Homebase Worker Pulse Survey.

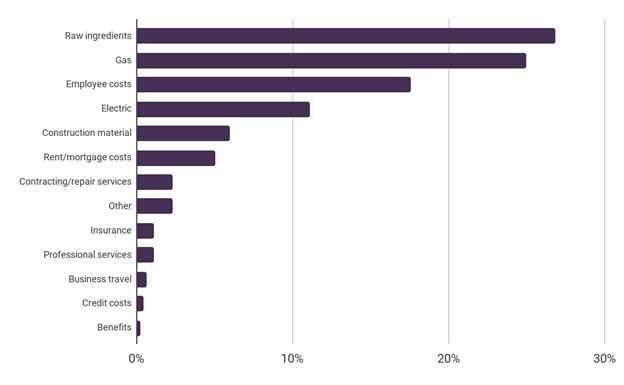

Twenty-seven p.c of householders ranked the value of uncooked substances or intermediate items as the fee that has been most impacted by inflation. The price of gasoline was a detailed second (25%), adopted by worker wage prices (18%). The price of electrical energy (11%) and development supplies (6%) spherical out the highest 5. As one proprietor put it:

“Enhance in costs for uncooked substances, provide chain points and shortages of many objects, mixed with the now due funds can have a big unfavorable influence on my enterprise.”

Survey query: Which of your month-to-month prices have been most impacted by inflation?

Supply: Homebase Worker Pulse Survey.

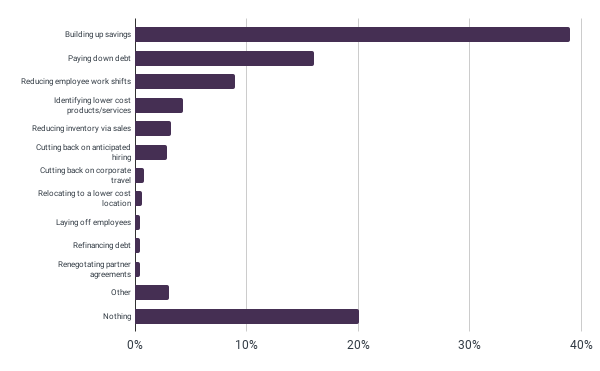

Most house owners are involved a few recession; they’re additionally taking steps to arrange for one. To arrange for a potential recession, house owners are taking related steps as their workers: First, they’re build up financial savings (39%). Second, they’re paying down debt (16%). Third, they’re lowering worker work shifts (9%). Lower than 0.5% of householders are preemptively shedding workers to arrange for a potential recession.